Psychology of Wealth – Implications for Designers

Sunday, January 22nd, 2012 The psychology of money has many twists and turns. The nuances may seem academic to some but they are fundamentally important for those of us that design incentives and rewards, financial products or educational materials about money management. That’s why I am always on the look out for new scientific research into how we think about money and wealth.

The psychology of money has many twists and turns. The nuances may seem academic to some but they are fundamentally important for those of us that design incentives and rewards, financial products or educational materials about money management. That’s why I am always on the look out for new scientific research into how we think about money and wealth.

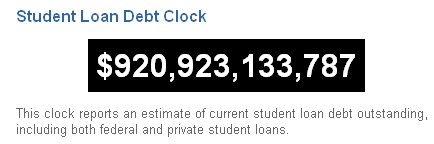

For example, Psychological Research recently reported some interesting findings:

“People generally like assets and dislike debt, but they tend to focus more on one or the other depending on their net worth,” says Sussman. “We find that if you have positive net worth, your attention is more likely to be drawn to debt, which stands out against the positive background.” On the other hand, “when things are bad, people find comfort in their assets, which get more attention.”

These findings contradict our normal assumptions and are strong enough to guide design decisions. For example, a person in debt may take out a loan to buy a consumer item when a person with net worth may forgo it.